County to discuss budget (& proposed tax increase) Tuesday, Sept. 4.

Posted on August 31, 2018

County commissioners will hold a special meeting to further discuss their proposed 2018-19 budget and millage rate on Tuesday, Sept. 4 at 9 a.m. – the morning after Labor Day.

Originally scheduled for Thursday, Aug. 30, the meeting was postponed at the request of a commissioner that had a scheduling conflict and will include discussion on the coming year budget and a tentative decision to raise the county’s property tax (millage) rate nearly 7% next year.

It will be first time the county has discussed the budget and millage rate since three of five county commissioners – Steve Spradley, Thomas Demps and Jim Moody — voted in favor of possibly raising taxes on Aug. 1 instead of holding to a 5% across-the-board budget cut agreed to during earlier budget workshops.

Commissioners can still elect to adopt the same millage rate as last year, adopt the “roll-back rate” (which would raise the same amount of taxes as the previous year) or even lower tax rates – but each of those options would require cuts to the current tentative budget.

During a July 19 budget workshop, all five commissioners publicly stated they were not in favor of raising taxes this coming budget year.

However, on Aug. 1 — faced with a room full of residents voicing their willingness to pay additional taxes instead of requesting Sheriff Wayne Padgett cut his budget — commissioners opted to instead raise property tax rates in the coming budget year.

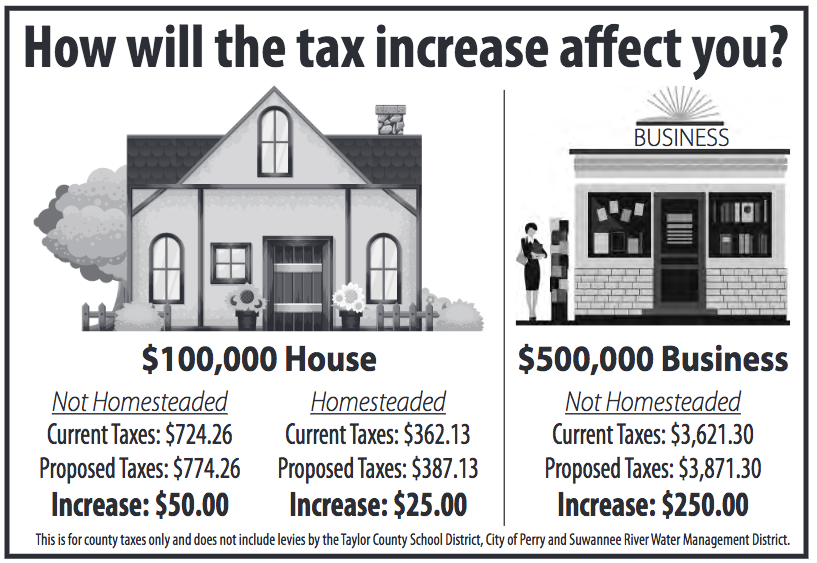

The county commission’s proposed .5 mill increase would increase Taylor County’s general fund millage rate 6.89% from 7.2426 to 7.7426 mills.

The millage rate is the tax rate per thousand dollars of taxable value.

To determine your ad valorem tax, divide the taxable value of your property by 1,000 and multiply by the millage rate.

For example, a home assessed at $100,000 in taxable value with a new millage rate of 7.7426 (the current proposed county tax millage only) would generate $774.26 in taxes – an increase of $50 over last year’s county tax bill of $724.26

If that same $100,000 home qualified for the first and second $25,000 homestead exemptions (reducing the taxable value to $50,000) the homeowner’s county taxes would rise from $362.13 to $387.13 next year – an increase of $25 if the proposed millage increase is adopted.

For a business or other non-homesteaded property valued at $500,000, the county’s proposed increase would cause a $250 tax increase from $3,621.30 to $3,871.30 in the coming year.

This proposed increase would generate $672,670 more in county taxes, raising the county’s general fund tax revenues from $9.755 million to $10.428 million.

The county’s will hold the first of two final budget hearings on Sept. 10 and Sept. 17 and must make a final decision on the possible millage rate and tax increase in time for county staff to prepare and advertise the proposed millage rate in the Friday, Sept. 14 newspaper.

Local homeowners and businesses should have received their first look at what their tax bill could look like two weeks ago when the Property Appraiser’s office sent out a TRIM (Truth In Millage) notice to all taxpayers.

Subscribe to our e-Edition and read the rest of the story. Already a subscriber? Click here to sign in.

Recent Comments